maryland digital advertising tax effective date

Historic Preservation Tax Credit Guidelines. Ecommerce businesses now need to understand and stay up-to-date with tax laws in over 12000 jurisdictions in the US.

Google Says It Won T Track You Directly In The Future As It Phases Out Cookies

Effective date unique for each municipality get the details.

. 10272011 repealed effective 630. Applicant must have an independent certified public accountant certify costs. View official contest rules California Supply Chains Act and franchise legal notices.

The new brackets and rates would be effective for the 2021 tax year. Each respective proposal includes the same three new tax rates985 percent 1085 percent and 1185 percentbut imposes such rates at differing income thresholds. Build competence in discussing problematic media design with families.

Learn challenges to foster children and their families due to the pandemic. Maryland is a destination state with no local tax rates. Most recently March 7th in an effort to clarify this for ALL advertising the Commission finalized the regulation Relations to the Public specifically as it pertains to digital advertising and detailed below with an explanation also known as the one-click rule Md.

We would like to show you a description here but the site wont allow us. Tue Jun 14 2022. Find terms and conditions as well as Chick-fil-As privacy policy for site users.

These updated terms will be effective no less than 30 days from when we notify you. 412020 Alaska Remote Seller Sales Tax Commission. These updated terms will be effective no less than 30 days from when we notify you.

Requests for final certification should be made prior to the expiration date of the tax credit reservation. DGLY the Company today announced its operating results for the first quarter of 2022. Maryland considers a seller to have sales tax nexus in the state if you have any of the following in the state.

Rates are set by fiscal year effective October 1 each year. An investor conference call is scheduled for 1115 am. A digital advertising tax similar to one Maryland has.

Effective July 1 2019 a remote marketplace facilitator with more than 100000 in Pennsylvania sales in the previous 12 months is required to collect and remit sales tax on all sales into the commonwealth ie cannot opt out by complying with non-collecting seller use tax reporting requirements. If an update affects your use of the Services or your legal rights as a user of our Services well notify you prior to the updates effective date by sending an email to the email address associated with your account or via an in-product notification. EDT on Tuesday May 24 2022 see details below.

Effective date unique for each municipality get the details. The tax credit reservation will expire 24 months from the date of issuance. Also Pillar 2s effective tax rate is determined on a country-by-country basis and GILTI is currently being calculated on.

227 AM UTC Gallery. Date and time. First Quarter 2022 Revenues Improve 306 Compared to 2021 LENEXA Kansas May 20 2022 GLOBE NEWSWIRE -- Digital Ally Inc.

Compare an individual-level perspective on digital media use with a systems-level perspective. It also provides additional guidance on. Apple Inc workers in Maryland voted on Saturday to join a union becoming the first retail employees of the tech giant to unionize in the United States.

Adding digital goods products and services to statutory language governing different types of taxes. 412020 Alaska Remote Seller Sales Tax Commission. If an update affects your use of the Services or your legal rights as a user of our Services well notify you prior to the updates effective date by sending an email to the email address associated with your account or via an in-product notification.

Find current rates in the continental United States CONUS Rates by searching below with city and state or ZIP code or by clicking on the map or use the new per diem tool to calculate trip allowances. The current maximum individual tax rate in New York is 882 percent.

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Md Digital Advertising Tax Bill

Maryland Tax On Digital Advertising Services Enacted Kpmg United States

Q1 Payments For Maryland Digital Ad Tax Due April 15 Bdo

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland Amends Its Digital Advertising Gross Revenues Tax Creating Additional Constitutional Infirmities Salt Savvy

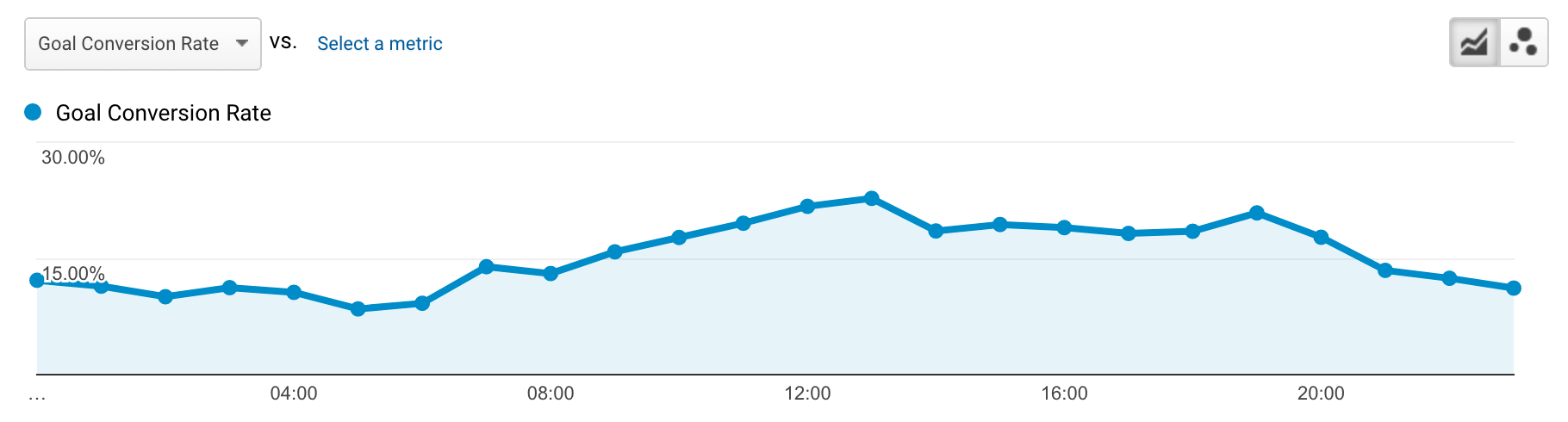

How To Optimize Your Google Ads Campaigns For Time Of Day

New Maryland Sales Taxes On Digital Products Computer Software E Books E Music Some Webinars And More Are You Up To Date Maryland Association Of Cpas Macpa

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp Jdsupra

Maryland Sales Tax Digital Products Baltimore Cpa Firm

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp Jdsupra

Maryland Taxation Of Digital Advertising Services Kpmg United States

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp Jdsupra

We Got Nothing Maryland Comptroller Finalizes Digital Advertising Tax Regs Salt Shaker

Maryland Delays Digital Advertising Services Tax Bdo

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland Digital Advertising Services Tax Kpmg United States

![]()

How To Get Certified By Google For Digital Marketing Navneet Vishwas

Maryland To Implement Digital Ad Services Tax Grant Thornton